State of Gaming for Marketers 2026 reveals how AI-driven scale, global UA spend, and China-based publishers are reshaping mobile gaming competition

Dubai, United Arab Emirates – January 15, 2026 – AppsFlyer, the Modern Marketing Cloud, has released the State of Gaming for Marketers 2026, an in-depth analysis of how AI, creative scale, and rising paid pressure reshaped mobile gaming marketing in 2025. Drawing on AppsFlyer data, the report examines how studios adapted as marketing activity expanded faster than player attention.

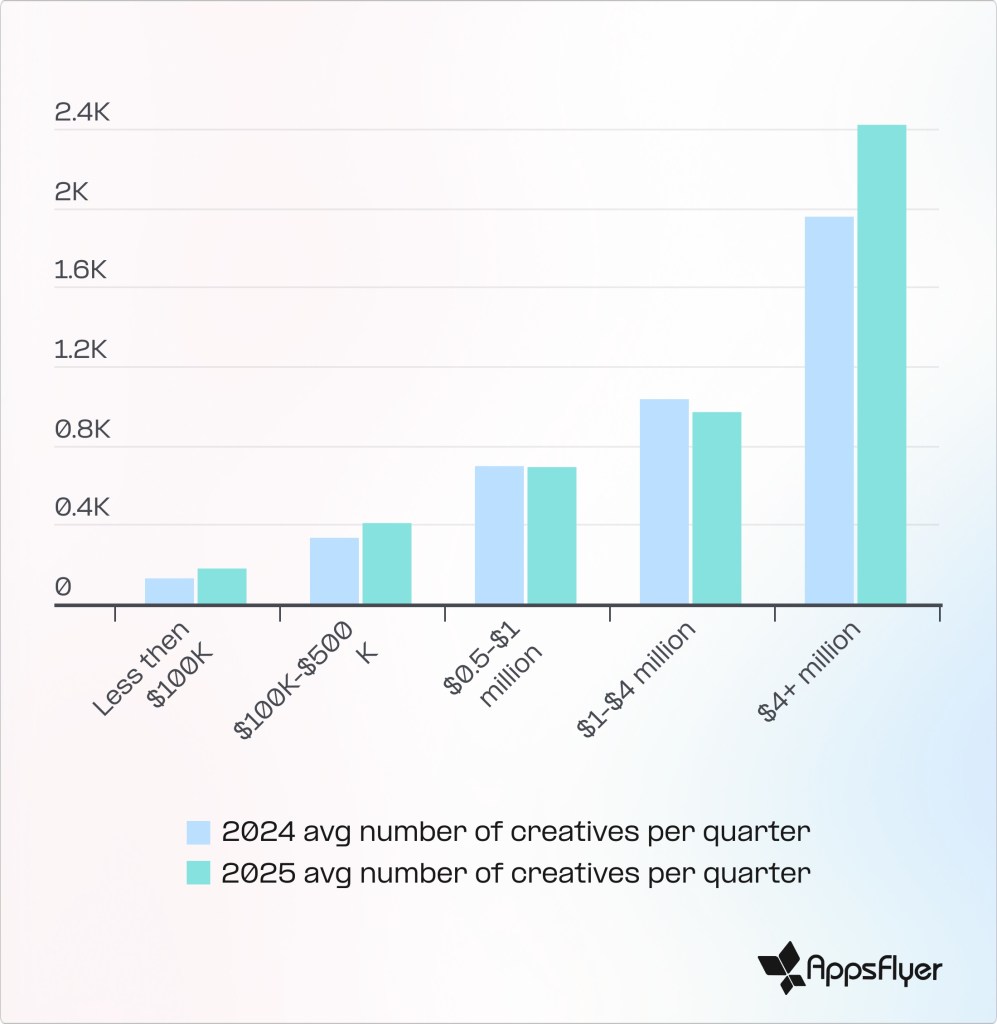

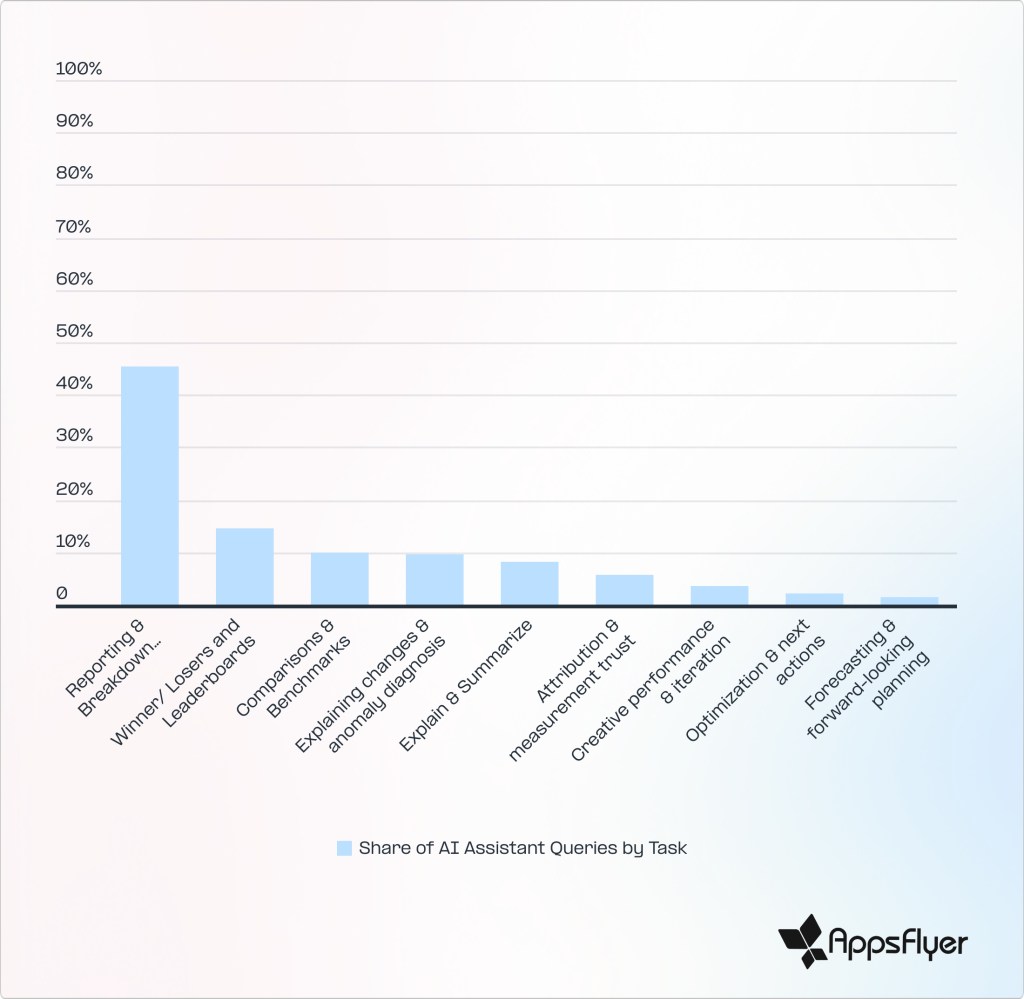

In 2025, AI-enabled production coincided with a sharp increase in advertising across iOS and Android. Creative output scaled rapidly across all spending tiers, with top gaming advertisers producing between 2,400 and 2,600 creative variations per quarter, up 25–30% YoY. That expansion increased pressure on paid acquisition channels. Paid install share rose 10% YoY across iOS and Android, while ad impressions increased 20%, indicating a significant rise in the number of ads competing for the same pool of players. To manage rising marketing volume and fragmentation, AI-enabled tools became a common part of daily workflows with 46% of AI assistant queries focused on reporting and performance breakdowns, reflecting the need for faster visibility as data volumes grew.

“AI has dramatically increased the speed and volume at which games and marketing assets reach the market,” said Adam Smart, Director of Product, Gaming at AppsFlyer. “The result is not a shortage of creativity, but a surplus of it. As paid activity and creative supply expand faster than player attention, marketing success depends on how effectively teams can measure, interpret, and act on an increasing volume of fragmented signals.”

Additional key insights from the State of Gaming for Marketers 2026:

- Global gaming app UA spend reached $25B in 2025. Total spend grew 3.8% YoY, with nearly half flowing into the US, even as budgets declined 5% YoY in the market. Growth shifted toward emerging regions such as Turkey (+29%) and India (+19%).

- China-headquartered publishers captured 35% of global gaming UA spend outside China. Their share grew by 22% YoY, with gains strongest on Android and across competitive Western markets including the US, UK, Germany, and France.

- AI is still used primarily to manage marketing scale, not strategy. With 46% of AI assistant queries focused on reporting and performance breakdowns, teams are using AI to keep pace with rising data volumes rather than replace decision-making, but some genres are already employing more complex tasks and asks.

- iOS advertisers expanded media mix to find incremental scale. iOS gaming advertisers increased the number of media sources they used by up to 15% YoY, reflecting growing fragmentation and the need to diversify beyond core channels.

The full report is available at: https://www.appsflyer.com/resources/reports/gaming-app-marketing/

– ENDS –

Methodology

AppsFlyer’s State of Gaming for Marketers 2026 is based on anonymized, aggregated data from 9.6 thousand gaming apps worldwide, analyzing 24.8 billion total installs, including 14.1 billion paid installs, alongside ad spend, creative production, monetization, AI-assisted workflows, and media source usage across iOS and Android during 2025.

About AppsFlyer

AppsFlyer is the Modern Marketing Cloud that helps businesses transform complex data into clarity and growth. A foundation for unified, measurable, autonomous marketing, AppsFlyer breaks down silos across measurement, deep linking, data collaboration, and autonomous AI workflows. For more than a decade, AppsFlyer has been the leader in mobile attribution, trusted by over 15,000 businesses worldwide. To learn more, visit http://www.appsflyer.com.