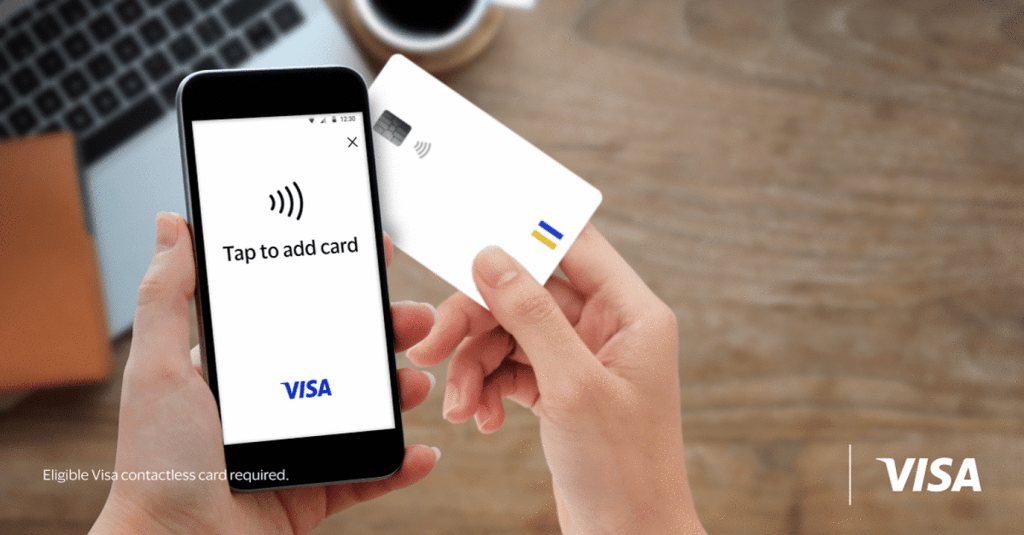

- Tap to Add Card enables cardholders to seamlessly add their cards to digital wallets by simply tapping them on their mobile device

- The solution eliminates the cumbersome process of manual entry, a common source of errors and a vulnerability exploited by fraudsters seeking to compromise sensitive card information

UAE, Dubai, 06 March, 2025: Visa (NYSE: V) today announced the launch of Tap to Add Card in the UAE marking a significant advancement in digital wallet provisioning. This innovative technology addresses the growing need for secure and streamlined digital payment solutions by allowing cardholders to add their Visa contactless cards to digital wallets with a simple tap on their mobile device.

Continue reading Tap, Add, Done. Visa Launches Tap to Add Card in UAE, Enhancing the Ease and Security of Adding Cards to Digital Wallets