Revenue and Net Profit Surge by Nearly 100%

FY 2025 Key Highlights

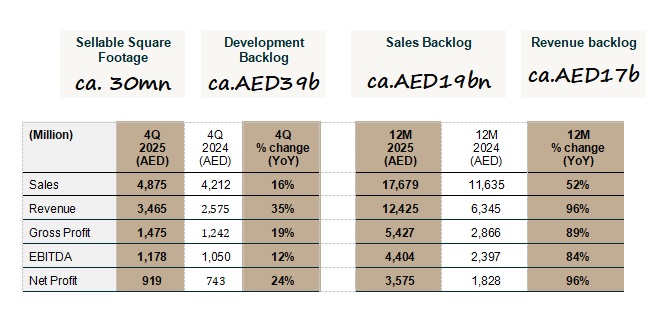

- Net profit rises 96% YoY to AED 3.58 billion

- Revenue nearly doubles YoY to AED 12.43 billion

- Gross profit up 89% to AED 5.43 billion; EBITDA up 84% to AED 4.40 billion

- Cash position increases 135% to AED 8.84 billion

- More than 17,000 units sold during FY 2025, making Binghatti Dubai’s top-selling off-plan developer by units sold

- Total assets grow 92% YoY to AED 24.37 billion

- Total equity more than doubles to AED 6.78 billion, supporting continued pipeline execution

- Binghatti’s combined portfolio of completed, ongoing and pipeline developments now stands at nearly AED 100 billion

Katralnada BinGhatti, CEO and Managing Director

“The year that just closed presents a defining period of growth for Binghatti and a clear validation of our strategy, execution discipline, and differentiated approach to development. Our record profitability and revenue performance are a direct outcome of Dubai’s strong market fundamentals and the efficiency of our vertically integrated business model, which enables us to move quickly from design to delivery while maintaining quality and cost control.

Throughout the year, we sustained strong sales momentum, accelerated project handovers, and continued to expand our development footprint across key locations and segments, reflecting both the strength of demand and the market’s confidence in Binghatti’s delivery track record.”

Shehzad Janab, CFO

“FY2025 was defined by disciplined execution and a resilient operating model that continued to perform even as the business scaled rapidly. Profitability remained strong, with a 44% gross margin, 35% EBITDA margin and 29% net margin. This performance highlights the strength of our vertically integrated model, our focus on cost efficiency and the results of a strategically balanced project portfolio.

Balance sheet strength also continued to improve meaningfully over the year. Total assets rose 92% year-on-year to AED 24.37 billion, reflecting the scale-up of our development activity and the continued expansion of our portfolio, while cash balances increased to AED 8.84 billion, providing a strong liquidity buffer and significant financial flexibility. This leaves us with ample liquidity to continue to execute our market-beating growth strategy whilst maintaining strong financial discipline.”

Continue reading Binghatti Posts Record Profits Three Years in a Row