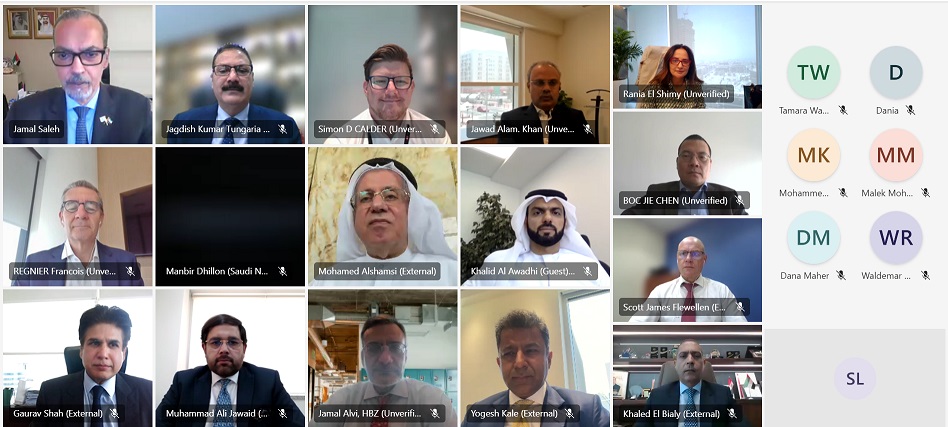

Abu Dhabi, United Arab Emirates; 27 June 2024: The CEOs Consultative Council of UAE Banks Federation, the sole representative and unified voice of UAE banks, held its second regular meeting for the current year yesterday (26 June 2024) under the chairmanship of H.E. Mohammed Omran Al Shamsi, Vice Chairman of UAE Banks Federation and Chairman of the Board of Directors of Ras Al Khaimah National Bank, to discuss developments in the banking sector and the Federation’s plans to be implemented in the second half of the year.

Participants at the meeting reviewed the steps taken by the Federation in the first half of the year to implement its strategy, plans and programmes, as well as the significant achievements made during this period to keep pace with the rapid developments in the banking sector.H.E. Mohammed Omran Al Shamsi, Chairman of the CEOs Consultative Council, said: “The banking sector has witnessed many remarkable developments in the first half of this year that have strengthened the sector’s leading position and helped cement the UAE’s position as a global financial and banking centre under the direct supervision of Central Bank of the UAE.

We at UBF are committed to working with our various strategic partners to ensure the adoption of best banking practices to provide a secure and seamless banking and financial experience.”The meeting, which was attended by CEOs and general managers of UBF member banks, praised the Federation’s efforts in the Emiratisation of the sector and implementation of its ambitious plan to increase Emirati participation in the banking and financial sector in line with the guidelines of Central Bank of the UAE’s through creating suitable and stimulating conditions to attract, train and qualify cadres to work in the country’s banking and financial institutions.The CEOs Consultative Council affirmed the ability of the banking sector to continue its strong performance while complying with regulatory and supervisory frameworks and maintaining strong capital efficiency, provisions and reserves, noting the efficiency of UAE banks in addressing global challenges that have affected various economies and sectors. This has enabled them to capitalise on the opportunities of the UAE’s dynamic and progressive economy and contribute to achieving the country’s strategic goals.The meeting underscored that the high level of customer confidence in the UAE banking sector, according to the Annual Trust Index Survey 2023 conducted by the Federation, reflects the remarkable progress in advancements, as well as the effectiveness and success of the initiatives undertaken by UBF and its members to ensure that they provide the services and products that meet the needs of different customers, as well as their commitment to the highest standards of customer service. Participants also emphasised the importance of maintaining the high level of customer trust received, as this is a cornerstone of the banking sector’s prosperity and business growth.It is worth noting that the Customer Trust Index in the UAE’s banking sector rose to 90% last year (2023), compared to 84% in 2022. The banking sector also maintained its first position as the most trusted sector in the country. The UAE ranked second globally in terms of customer trust in banks in 2022.Participants at the meeting acknowledged the contributions of Central Bank of the UAE, the Securities and Commodities Authority, the Ministry of Finance, the Ministry of Justice, the Dubai Courts, the Cyber Security Council, the police departments of Abu Dhabi, Dubai, Sharjah, Ajman and other partner. The meeting also highlighted the unwavering support from Central Bank of the UAE in the Federation’s efforts to strengthen the country’s leadership in the financial and banking sector through joint initiatives in keeping pace with legislative, regulatory and technological developments or to protect the digital infrastructure of the sector in order to provide the best banking and financial services to various customer segments, be it individuals, SME or large corporation.The Consultative Council also emphasised the importance of furthering the development of innovative banking solutions, investing in services and products that support the SME sector and entrepreneurs, and promoting sustainable finance in order to achieve the Sustainable Development Goals. During the meeting, Mr. Jamal Saleh, Director General of UBF, presented an overview of the performance of the UAE banking sector and the achievements made by UBF in the first half of the year in implementing programmes and initiatives under the Federation’s strategy for 2024 to support the leadership of the banking and financial sector in the UAE.The Director General of UAE Banks Federation said: “Our Advisory and Consultative Councils, comprising the CEOs of the member banks, continue to play an important role in achieving the strategic priorities of the Federation, especially Emiratisation, Sustainability, Compliance, Governance and Transparency, Accelerating Digital Transformation, Enhancing Financial Inclusion and Supporting Small and Medium Enterprises, under the directives of Central Bank of the UAE. The two councils contribute to strengthening the work of the General Secretariat and the Federation’s technical and advisory committees by broadening the base for participation in decision-making to develop the banking and finance sector further, meet customer needs and consolidate the UAE’s leading position as a global financial and banking centre in line with the guidelines and strategies of Central Bank of the UAE.”-Ends-